Dejure is the world’s first blockchain platform for litigation finance and alternative assets. Owned and operated by a litigation finance company, LawCoin, Inc., Dejure helps enable liquidity solutions for businesses, law firms, and litigants by providing accredited investors with access to litigation related assets. Founded in 2018, the company is a privately-owned Delaware corporation with principal offices in Philadelphia. Our team consists of lawyers with decades of litigation experience. You can learn more about us here.

Dejure is the world’s first blockchain platform for litigation finance and alternative assets. Owned and operated by a litigation finance company, LawCoin, Inc., Dejure helps enable liquidity solutions for businesses, law firms, and litigants by providing accredited investors with access to litigation related assets. Founded in 2018, the company is a privately-owned Delaware corporation with principal offices in Philadelphia. Our team consists of lawyers with decades of litigation experience. You can learn more about us here.

Litigation is expensive. Filing and prosecuting a lawsuit includes expenses like court costs, depositions, experts, attorney’s fees, and other expenses. Pursuing a high-stakes lawsuit is costlier and more uncertain than ever. Litigants often have difficulty pursuing even the most meritorious claims because they lack funds or have other needs for their capital. The result is lost value for individuals, for businesses, and for the law firms that serve them. This has historically been an unsolved problem in the U.S. legal system, not to mention worldwide.

Litigation finance has developed to allow third parties, including investors, to provide capital to a litigant to finance all or a portion of the legal fees and costs of a lawsuit. In return for providing capital, third parties can earn a return on the funds they advance, if the lawsuit is successful. The rise of litigation finance has allowed more meritorious cases to be brought and has empowered more litigants, large and small, to pursue their rights.

When considering high-stakes litigation, Dejure can help businesses, law firms, and litigants raise the capital that is needed to prosecute their case.

Through indirect single purpose special purpose vehicles, Dejure provides accredited investors with new and meaningful access to litigation finance, a growing uncorrelated asset class that has been historically available only to very large institutional investors.

If you are an attorney, a plaintiff, a business with litigation seeking working capital, or a business seeking funding for your legal claims, you can submit your case for review here.

If you are interested in investing in legal claims, you can begin the process here.

If you are an attorney, a plaintiff, a business with litigation seeking working capital, or a business seeking funding for your legal claims, you can submit your case for review here.

We evaluate all types of claims and fund individual cases, law firm portfolios, and offer a variety of litigation finance options, including the purchase and assignment of absent class member claims.

Many cases are referred to us by law firms who have clients with a strong claim, but who lack the resources to cover the costs of the litigation. When you submit a case to us, we commit to reviewing it promptly and to providing you with an expert assessment of its suitability.

For law firms who handle a significant amount of claimant-side litigation or arbitration work, we can also offer law firm finance via portfolio finance arrangements.

Even large, financially secure companies are turning to third-party litigation finance as a risk-management and finance tool. Litigation finance allows companies to provide greater flexibility in their approach to risk management.

Insolvency practitioners also use litigation finance to pursue large scale assets which, without external finance, can remain beyond the reach of creditors.

Some examples of the types of cases we evaluate for financing are listed in the below table.

Types of Cases

Whistleblower

Lawsuits against defendants that contain whistleblower claims for fraud and other misconduct.

Fraud

A false representation of fact by falsifying, misleading, or concealing what should have been disclosed

Breach of Contract

When a binding agreement or bargained for exchange is not honored by one or more parties.

Intellectual Property

Claims that relate to misuse of intellectual property, including patent, copyright, trademark and theft of trade secrets.

Business Torts

Wrongful acts committed against businesses, often intentional, but sometimes due to negligence.

Arbitration

The settling of disputes between parties by a private arbitration proceeding, frequently having and international angle.

Personal Injury

When a person is injured due to negligence of another, they may be titled to compensation.

Class Action

Class action lawsuits involve a sizable number of individuals who have been injured by a single product or company.

We are committed to protecting the privacy and confidentiality of information. Our initial review will be based on the information you provide online or over the phone regarding your client’s case and only information which is publicly available or discoverable may be provided to our online platform. Additional information and supporting documentation may be requested. The involvement of passive investors in legal claims does not affect the attorney-client privilege or put attorney work product at risk. Recent court decisions have upheld that attorney work product shared with third-party funders is protected and communications with third-party funders are covered by the “common-interest” doctrine. For funded cases or portfolios, we will typically be entitled to receive material updates from the attorney of record and will monitor the case and periodically provide relevant updates to our investors based only on publicly available information.

Our investment platform is open to accredited investors and institutional investors, including family offices, hedge funds, and asset managers.

To invest through the Dejure platform, we will require information from you, including, but not limited to, a valid tax payer number (EIN#, SSN#, or TIN#) and proof of identity and proof of residence are required. You must also be verified as an accredited investor, as investment interests are offered pursuant to Regulation D Rule 506(c). The accredited investor verification can be accomplished with (1) an accredited verification letter signed by a third party such as a CPA, lawyer, or investment professional; (2) income proof in the form of tax returns or W2s for the two most recent tax years ($200K/yr for the past two years as an individual, or $300K/yr if joint, and reasonably expect the same for current year); or (3) asset proof in the form of bank account or brokerage statements (must exceed $1M, excluding the value of your primary residence).

Yes, you can invest with an Entity. You can add an investor account for your entity. You will be prompted to upload various entity documents depending on the nature of your incorporation. Additional documentation will be required for each of the owners of the entity as well as personal information on each of the Ultimate Beneficial Owners (“UBO”s). If not providing third-party verification of the entities qualification for these investments, all owners (if you are not the sole owner) must be accredited or the entity itself must have assets in excess of $5M.

Yes, you can invest with a trust. If you are the trustee of the trust, you can invest if:

- It is a revocable trust and the grantor is accredited; and

- It is an irrevocable trust and either has >$5M assets or all of its beneficiaries are accredited.

You’ll also be prompted to upload the Trust Agreement as well as other entity documents and indivisual documents for each member of the trust.

Dejure provides investors access to alternative investments, typically legal claims. In particular, investment opportunities posted on or offered through Dejure are indirect investments in legal claims offered through special purpose vehicles (“SPV”) managed by an affiliate of LawCoin Inc. (“LCX”) and sold through Tritaurian Incorporated, a registered broker dealer and member FINRA/SIPC. An SPV is an investment structure that is technically a subsidiary of the company that created it (LawCoin). That means it is reported on a separate balance sheet, has a scope that is just a subset of the parent company’s activities and is financially independent of the parent company and from other SPVs under the parent’s umbrella. Each investment structured as an SPV is its own limited liability corporation (“LLC”). When you invest you are typically purchasing equity in an LLC as a limited member. LCX acts as the managing member of each SPV. This means that LCX services and distributes the funds and informs investors of any important administrative matters. If any complications arise in the portfolio, LCX—as managing member—will handle them. The ownership of an SPV is split among all investors in the offering at a basis corresponding to your contribution to the deal. Those shares are issued and tracked on our blockchain platform.

Investments in lawsuits have typically been in the form of direct contracts or limited partnership interests in special purpose vehicles created for the particular case investments. Both of these methods are highly illiquid.

Blockchain technology can offer the potential for greater access to global capital, lower costs of entry, fractional ownership, no time limitations, increased liquidity, programmable governance, expedited execution, and increased confidence. In particular, using blockchain technology to tokenize securities creates several potential advantages as a means of holding and trading in securities by eliminating burdensome paperwork and legal fees; embedding securities compliance and other legal restrictions into the security to reduce risk and minimize transaction costs; and authenticating and approving transactions without the need to secure confirmation from the issuing company. The efficiencies of digitized securities also has the potential to simplify secondary trading and increase liquidity for investors. In other words, investors can potentially rely on ownership authentication, reduce costs, and more easily sell securities.

By using blockchain technology, we can help facilitate ownership and transfer of security interests in legal claims and allow the trading of those securities to other investors efficiently and with low transaction costs, providing that regulatory restrictions are observed. By tokenizing litigation finance investments and offering a platform where they can be issued with the potential future capability of trading on third-party exchanges, we also bring much-needed liquidity to the litigation finance market.

We create a variety of product types, ranging from individual case investments to portfolio funding to open funds. Below is a chart of some different types of offerings.

Flexible Product Offerings

Portfolio Fund

Portfolio funds provide institutional and individual accredited investors the ability to access a portfolio of litigation-related assets through a single fund allocation.

Individual Offerings

Individual offerings provide institutional and individual accredited investors the ability to invest in individual cases or other litigation-related assets.

Social Impact

Social Impact investments primarily seek to encourage or support common good, with a secondary objective of creating investor returns.

Open Funds

Our Open Funds seek to source and invest in cash-flow producing and asset backed opportunities across multiple asset classes. The objective of these funds is to generate returns for our investors through diversification, defraying through some of the risks associated with single case investments .

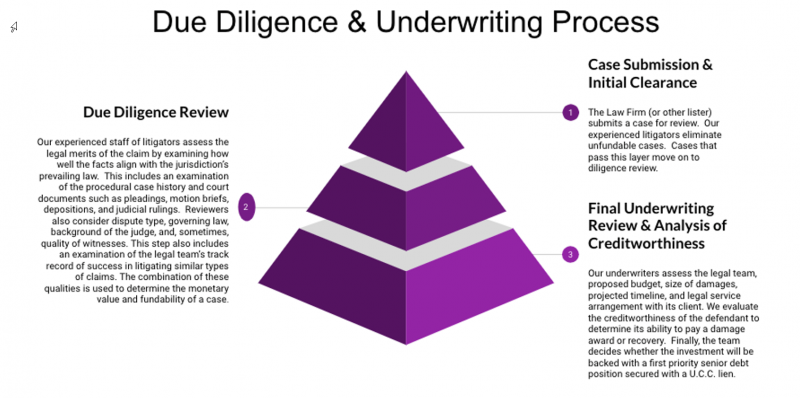

We have a rigorous vetting process wherein we review investment opportunities with the following characteristics:

Type of matter: We seek high-value litigation at any stage, including personal injury, antitrust, securities, fraud, contract, patent and intellectual property, trade secret and other business tort matters, as well as international arbitration.

Strong merits: Investors receive returns only when cases succeed, so we carefully assess the facts and legal merits of a claim, starting with an operative complaint or written summary.

Counsel: The platform values cases led by experienced litigation counsel with successful track records and a strategic approach. During initial review, we confirm that counsel has been retained and has performed an analysis of the factual background and legal issues of the case. Attorneys may be working on a contingency or hourly basis.

Jurisdiction: We consider matters filed or expected to be filed in domestic courts in a common law jurisdiction or in an internationally recognized arbitration center.

Capital requirement: Although we have no minimum investment amount, investors, clients, and firms get the best value when the funding amount requested is $100,000 or more.

Damages: We require investments that have damages supported by solid evidence of loss and that are large enough to support investment and returns with the client keeping most of the litigation proceeds if the case goes well. Although the ratio of investment to expected recovery varies depending on the case, for an investment of $1 million, the expected damages should be estimated at approximately $10 million. For an investment of $100,000, the expected damages should be estimated at approximately $1 million.

In certain circumstances, a Dejure affiliate may charge investors a 1-2% management fee and charge the originator a listing or tokenization fee. A Dejure affiliate also may take a share of the profits, referred to as carried interest, from each investment vehicle that is successfully funded. In certain instances, Dejure affiliates are also entitled to receive an administration fee and interest and fees related to financing for prefunded deals. Also, a broker fee will be paid to Tritaurian Incorporated, the broker-dealer for all offerings referred to or posted on the Dejure platform. These fees are disclosed on the individual offering pages for each investment opportunity.

We are committed to protecting the privacy and confidentiality of information. Please see our Privacy Policy and Terms of Use.